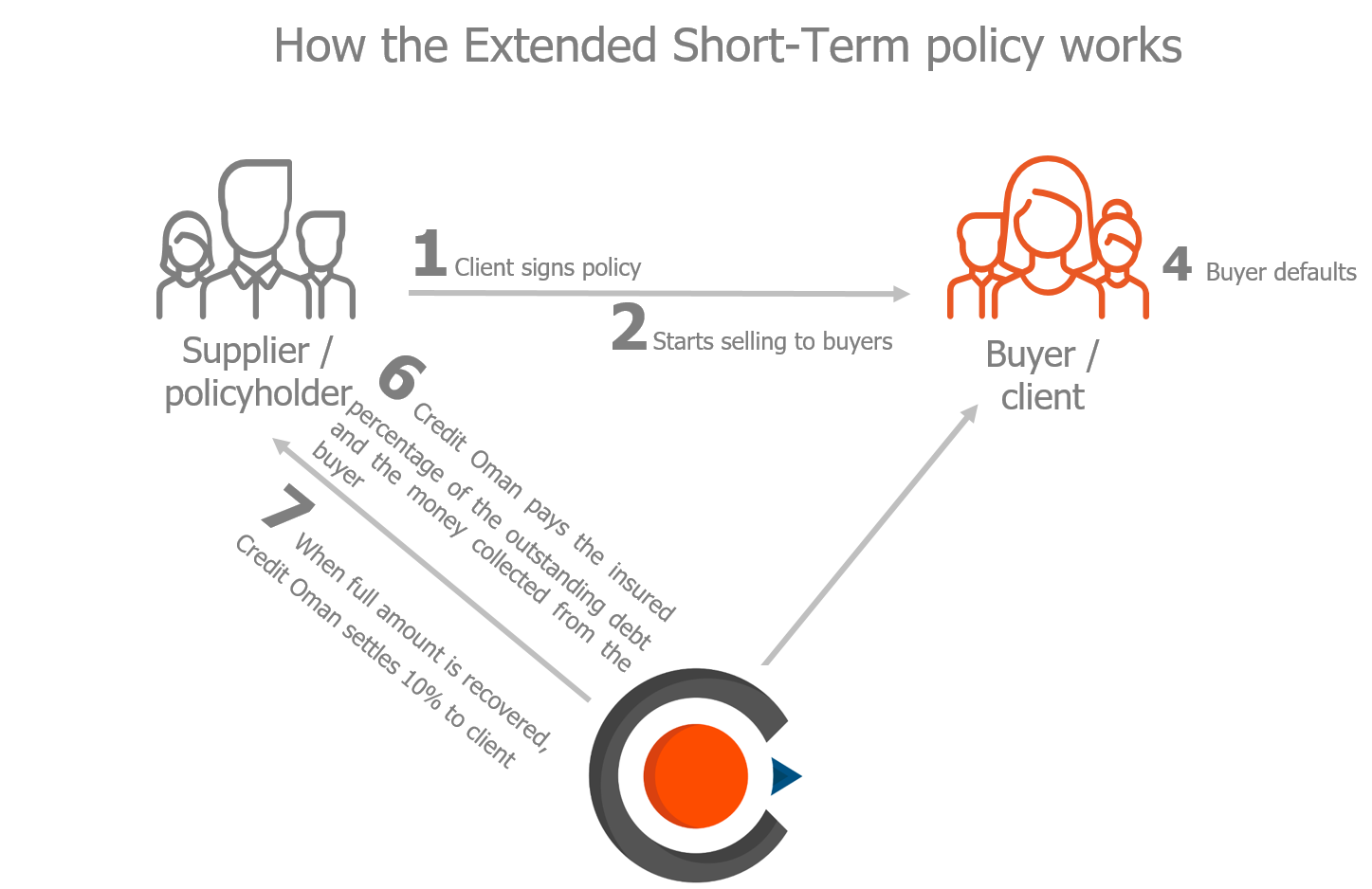

The extended short-term credit insurance policy insures its holders against the payment default of their corporate buyer for the sales of goods and services, payable by installments, over a period of up to 36 months.

This policy is ideal for both corporates and banks based in Oman. Corporates who lease or sell products and services for a period exceeding 180 days and on installment basis, or are involved in short-term projects with payment installments. Banks can also benefit from such a product, specifically when the financing is made to corporates for the purchase of products (traditionally vehicles and machinery) with payment installments.