For companies registered in Oman, seeking to trade with local buyers or export their products or services internationally, the short-term trade credit receivables policy safeguards sales transactions and protects cash flow.

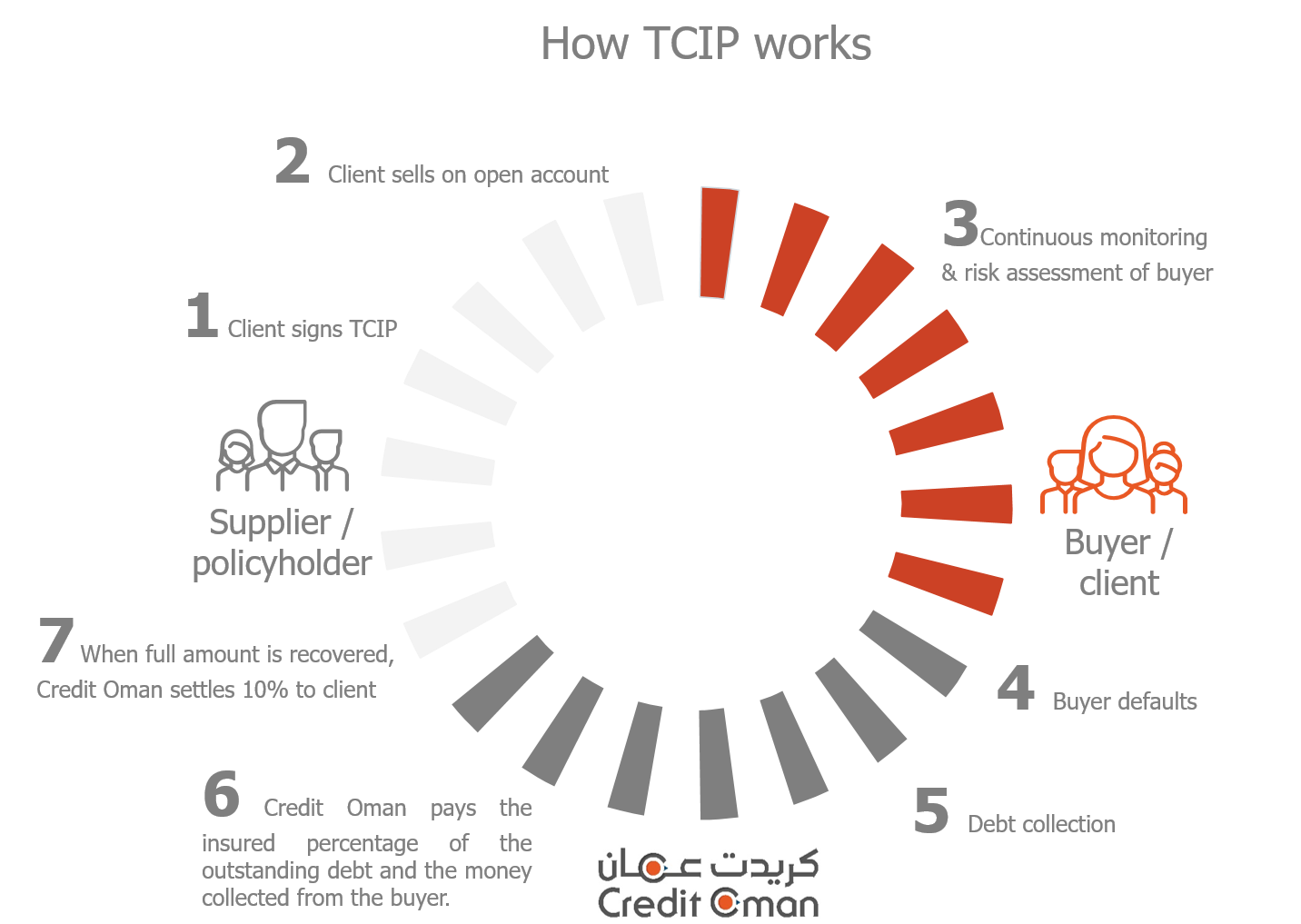

Trade credit insurance is used by companies as a balance sheet protection option for short term receivables (up to 180 days), helping them mitigate an array of risks, namely the non-payment of trade receivables by buyers. Non-payments can happen for various reasons, including commercial risks (protracted default and insolvency/bankruptcy), as well as political risks for exports. Should a client default, Credit Oman will settle up to 90% of the insured debt. Once the bad debt is collected from the buyer, the remaining amount will be settled to the policyholder.

Trade credit insurance is integral for companies to protect their biggest asset (their trade receivables). For short-term export policies, political risks are immediately covered, enabling companies to trade internationally and expand the reach of their sales, in a safer manner.

This policy covers the risks associated with multiple buyers.