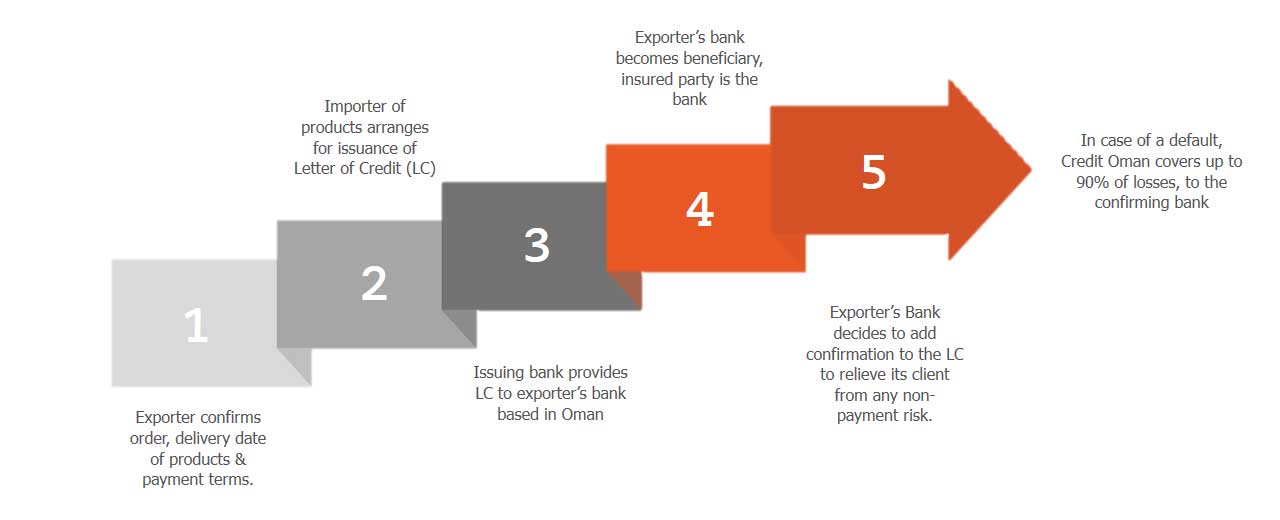

DCIP provides cover against the non-payment and insolvency of the LC opening bank (Importer’s bank) while adding confirmation to the Letter of Credit, thereby absolving its exporter client from all the credit risk involved in the transaction.

Maximum protection to commercial banks for adding confirmation to the LC is 90% while the banks need to retain a minimum risk of 10% to its account.